Trading in the foreign exchange market carries some risks and can cause you part or complete loss of your funds. The degree of risk depends on many factors. Manually controlling these factors is an objectively difficult task.

We have developed a unique risk management system that protects investors from unplanned losses and additionally controls managers, freeing them from psychological stress.

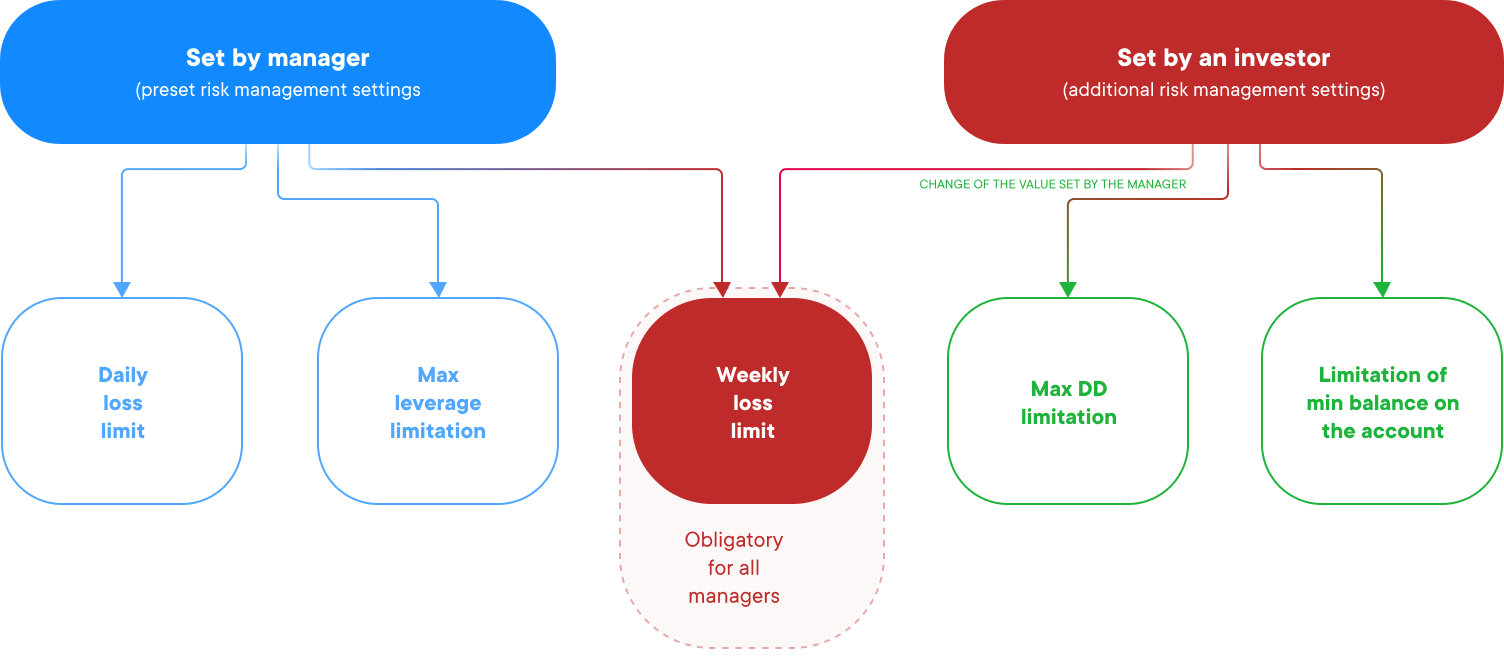

The manager sets part of the limits (mandatory part of the system). These limits are mandatory and pre-defined for investors. The investor can establish personal risk management limits (additional part of the system).

Benefits of the risk management system

For the manager

-

Freeing the managers from psychological stressA manager cannot alter the parameters of risk management limits at will directly in the course of trading. As a result, the probability of deviating from the trading system and the chance of an increase in risk are all minimized. The manager is protected from committing mistakes caused by the impact of strong emotions.

For the investor

-

Additional risk managementSome investors have extensive experience and knowledge in portfolio management. So when needed, the investor can adjust the limits of risk management parameters at his/her discretion.

-

The risk management system does not depend on managersThe manager cannot alter the risk management parameters at any time. As a result, the investor's loss is prevented from exceeding the regulated level at the moment the investor invests in the managed account. Parameters are changed only with the consent of ICE Markets and after all the investors involved have been notified and provided with the opportunity to stop working with the managed account until such changes come into effect.

-

Simplified portfolio management calculationsThanks to loss limits, the investor can make accurate calculations related to distribution of portfolio shares between managed accounts and risk level of the portfolio and its components.

Risk management limits can be set in the managed account settings in the personal profile.

The risk management system allows to set the limits of 5 different parameters – once any of these parameters is triggered, trades will be closed at the current market quotes, and trading activity will be blocked for a certain time.

The manager sets part of the limits (mandatory part of the system). These limits are mandatory and pre-defined for investors. The investor can establish personal risk management limits (an additional part of the system).

Types of limits

Established

by the manager

by the manager

Maximum leverage limit

You can set the maximum leverage limit.

Maximum daily loss

This limit is similar to the "maximum weekly loss" limit. It limits the maximum loss for the day. This limit is calculated based on the equity value at the beginning of the trading day, regardless of how much the account equity grows within this period (unlike the maximum drawdown limit, which is calculated based on the maximum equity after this limit has been set).). It is expressed as a percentage of the deposit.

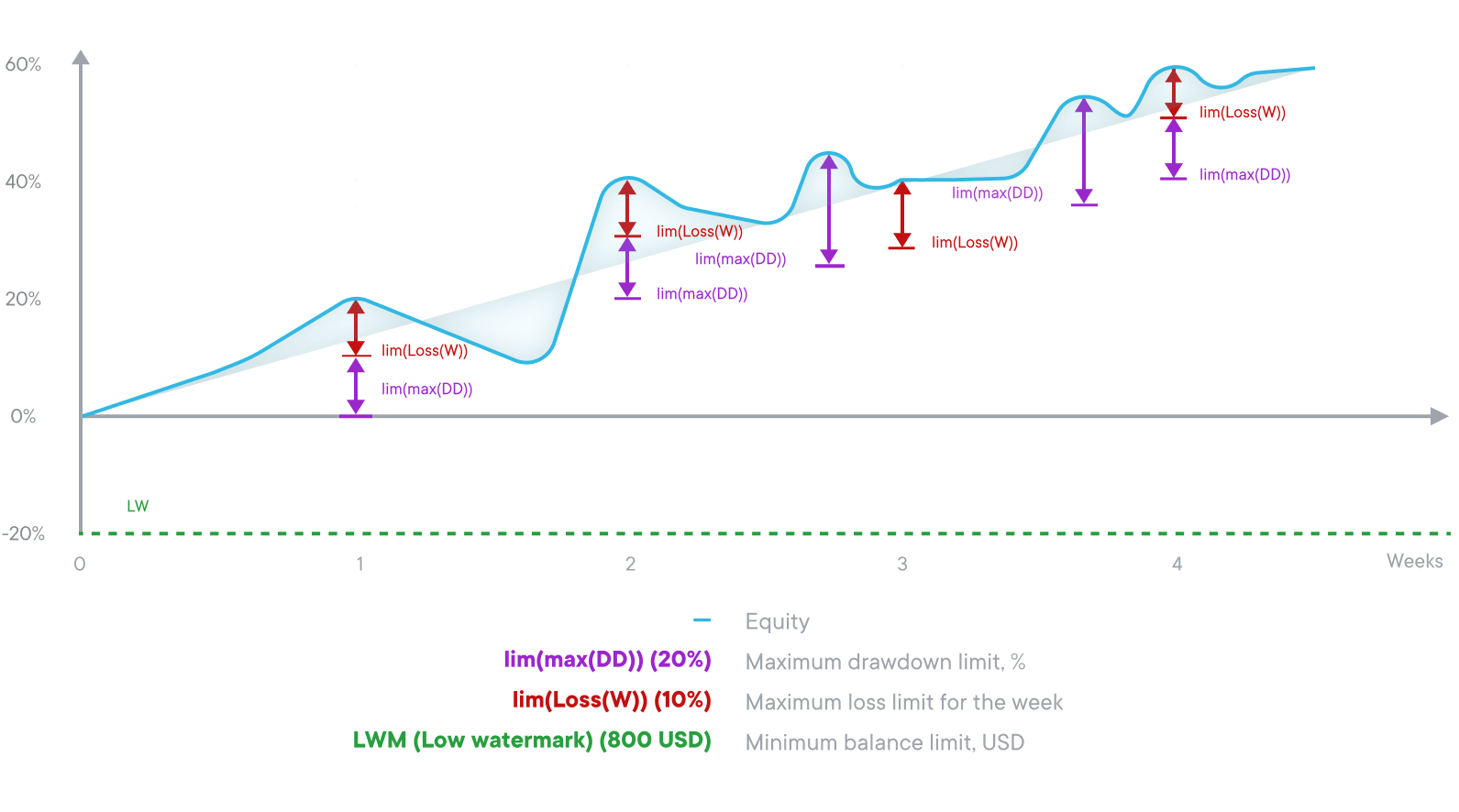

Maximum weekly loss

This limit is similar to the "maximum weekly loss" limit. It limits the maximum loss for the day. This limit is calculated based on the equity value at the beginning of the trading day, regardless of how much the account equity grows within this period (unlike the maximum drawdown limit, which is calculated based on the maximum equity after this limit has been set).). It is expressed as a percentage of the deposit.

Set by

the investor

the investor

Maximum drawdown

The maximum drawdown limit is calculated based on the maximum value of the account equity in existence after this limit has been set. If after some time the account equity falls to the value of the established maximum drawdown, this limit will be triggered (comparable to Trailing Stop in the MT 4 terminal). It is expressed as a percentage of the deposit.

Minimum balance

It indicates the minimum amount that when reached, limit will be activated and trading on the account will stop. It is expressed in the currency of the deposit.

Risk Management Schedule

| Kind of limits | Baseline | Limit conditions | Trade continuation (not earlier than) | When parameter changes come into force | ||

|---|---|---|---|---|---|---|

| Reducing the Limit Value | Increasing the Limit Value | |||||

| Restriction is established by the manager | Maximum loss limit for the day 4 | The value of the account equity at 00:05 (EET) of the current trading day | The value of the account equity (in percent) falls by the size of the given limit | 00:05 (EET) of the next trading day | 00:05 (EET) of the Monday of next week | 00:05 (EET) Monday of the following week |

| Maximum leverage limit 1, 3 | 00:05 (EET) Monday of the following week | 00:05 (EET) Monday of the following week | ||||

| The restriction is established by the manager and can be changed by the investor | Maximum weekly loss 1, 2 | The value of the account equity at 00:05 (EET) of the Monday of the current week | The value of the account equity (in percent) falls by the size of the given limit | 00:05 (EET) of the Monday of next week | Change is initiated by the manager: 00:05 (EET) Monday the week after the current week (the soonest weekly rollover + 1 week) Change is initiated by the investor immediately. |

Change is initiated by the manager: 00:05 (EET) Monday the week after the current week (the soonest weekly rollover + 1 week) |

Note!

- Past performance does not guarantee future results. ICE Markets cannot guarantee your future results and/or success.

- ICE Markets provides only managed account service for investors and managers. The company is not a representative of any of the parties to trust management.

- ICE Markets does not participate in managing the funds of clients that are investing in managed accounts.

- Leveraged investing exposes an investor to higher risk and can lead to complete or partial loss of one's funds.

- If you do not fully understand the investment process or the degree of risk you may be exposed to, consult a third-party specialist for advice.

- The minimum amount required by a manager to open a managed account is $300.