Trading in the foreign exchange market carries some risks and can cause you part or complete loss of your funds. The degree of risk depends on many factors. Manually controlling these factors is an objectively difficult task.

ICE Markets Limited ("ICE Markets") developed a system for external monitoring of traders' trading activities. The system is available to everyone. A trader can set a number of limits, which, when breached, the trading will be automatically closed and any further trading activity will be blocked for a certain period of time. It is also impossible to make any instant changes to limit levels. Therefore, the trader cannot go beyond his initially defined loss limit when the loss starts increasing.

Go to the "Functional" section to see the types of limits and their features.

Benefits

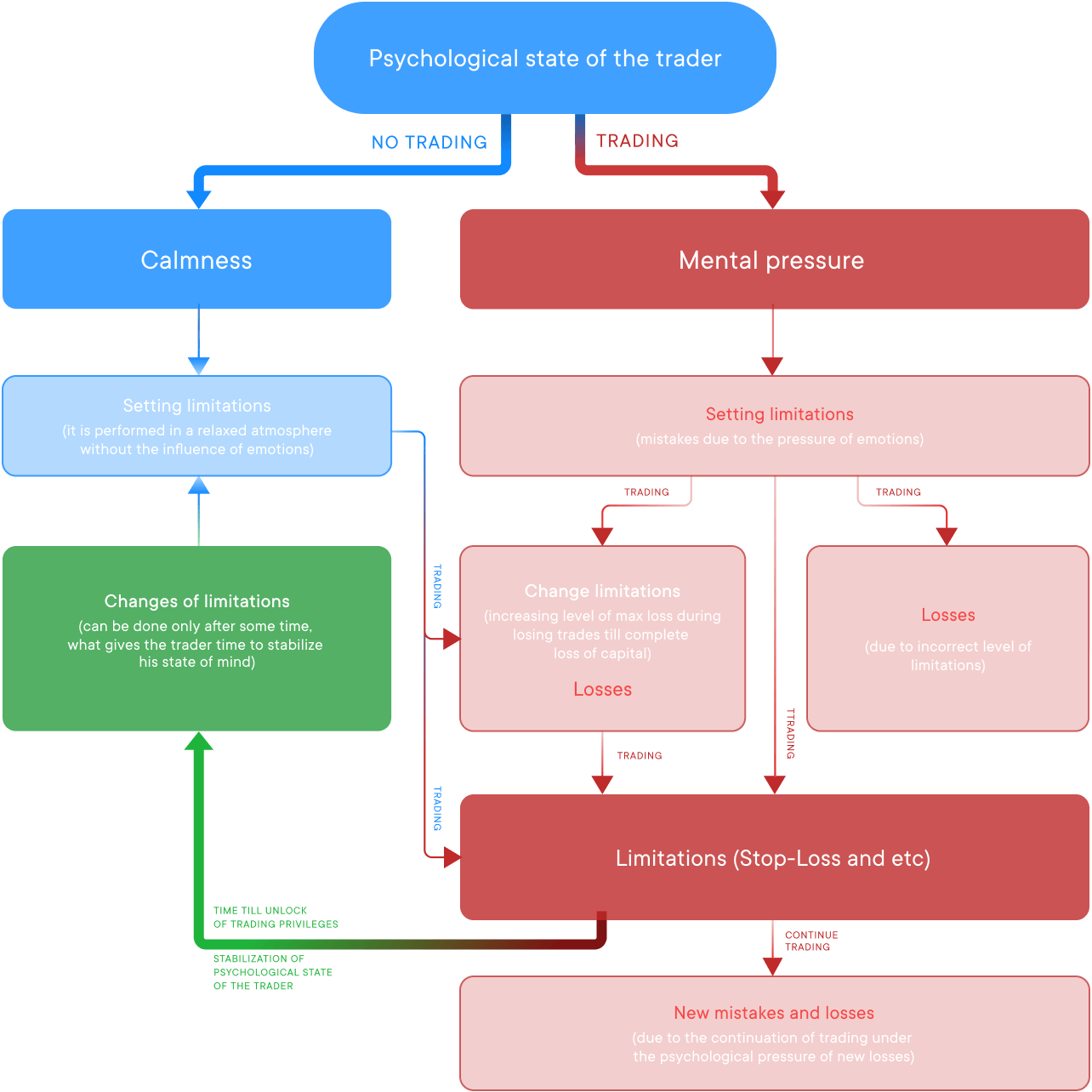

The trader is freed from psychological stress when he/she knows that the existing loss limits cannot be changed during trading.

The trader cannot (for some time period) continue trading after one of his/her set limits has been breached. Trading resumes usually in the beginning of the next trading week. This enables the trader to avoid trading under psychological pressure – the trader has time to calm down and review his mistakes till next week.

The trader cannot change limit levels instantly: a request to change a limit level is executed not earlier than the beginning of the next trading week. Thus, a trader cannot increase his loss limits under psychological pressure.

The trader is protected against erroneous actions that may be taken under strong emotional influence.

The trader is protected against "emissions", "black swans", etc. It is not in all cases that the trader can immediately react to sudden unexpected movements in the market. This can lead to by far higher losses than the expected. The external risk management system works round-the-clock and reacts instantly. This can help minimize losses (it should be noted that the risk management system cannot bypass such market attributes as "slippage", "requotes", etc.).

The risk management system is available in the personal account in the trading account settings./div>

The risk management system allows you to set the limits for 5 different parameters. If any of them is breached, trades will be closed instantly at the current market quotes, and trading activity blocked for a certain time period. Setting these limits is optional.

Maximum leverage limit

You can set the maximum leverage limit.

Maximum daily loss

This limit is similar to the "maximum weekly loss" limit. It limits the maximum loss for the day. This limit is calculated based on the equity value at the beginning of the trading day, regardless of how much the account equity grows within this period (unlike the maximum drawdown limit, which is calculated based on the maximum equity after this limit has been set). It is expressed as a percentage of the deposit.

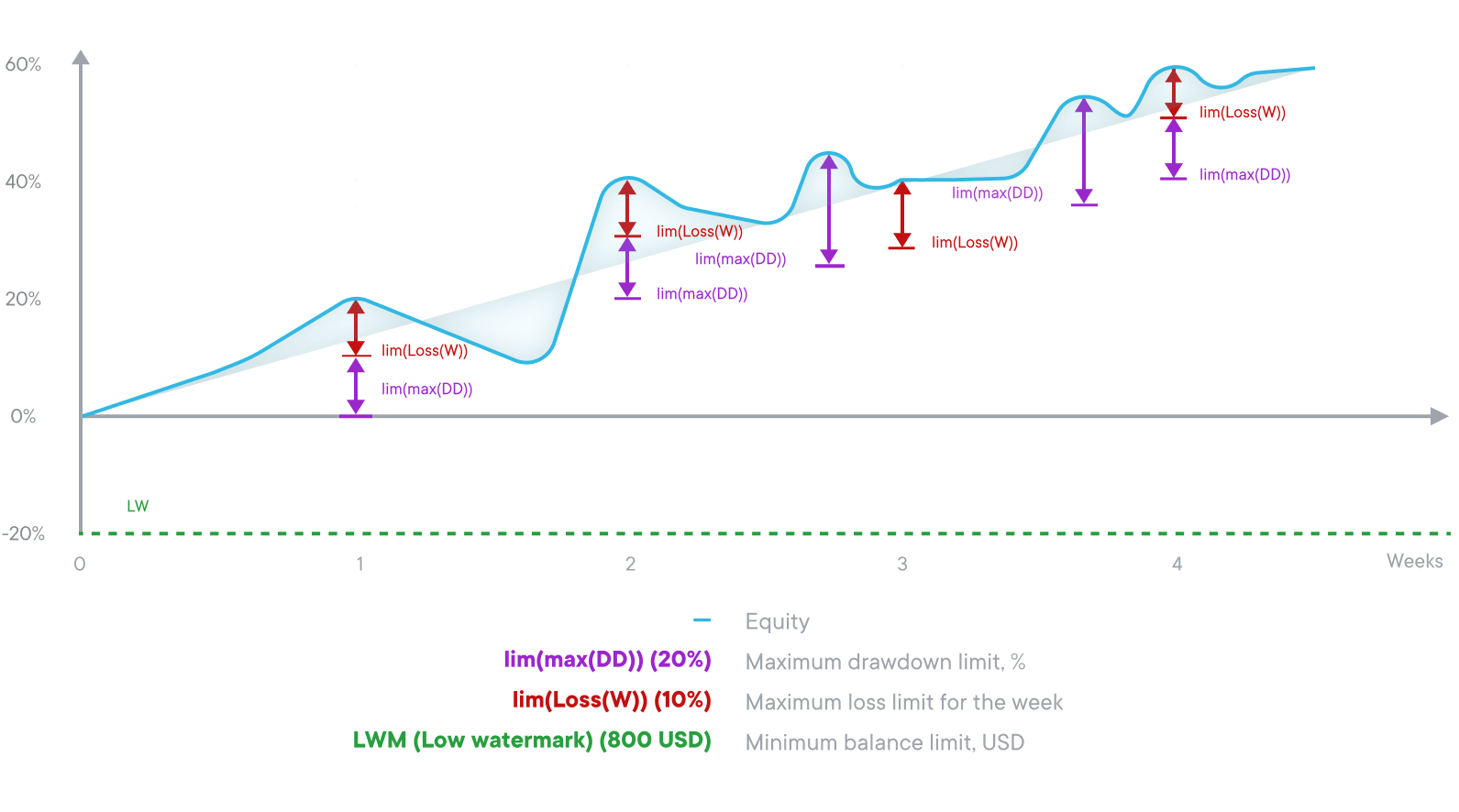

Maximum weekly loss

It limits the maximum loss for the week. This limit is calculated based on the equity value at the beginning of the week, regardless of how much the account equity grows within this period (unlike the maximum drawdown limit, which is calculated based on the maximum equity after this limit has been set). It is expressed as a percentage of the deposit.

Maximum drawdown

The maximum drawdown limit is calculated based on the maximum value of the account equity in existence after this limit has been set. If after some time the account equity falls to the value of the established maximum drawdown, this limit will be triggered (comparable to Trailing Stop in the MT 4 terminal). It is expressed as a percentage of the deposit.

Minimum balance

It indicates the minimum amount that when reached, limit will be activated and trading on the account will stop. It is expressed in the currency of the deposit.

| Kind of limits 1 | Baseline 2 | Limit conditions | Trade continuation (not earlier than) |

When parameter changes come into force 3 | |

|---|---|---|---|---|---|

| Decrease of the limitation level | Increase of the limitation level | ||||

| Maximum daily loss limit | The value of the account equity at 00:05 (EET) of the current trading day | The value of the account equity (in percent) falls by the size of the given limit | 00:05 (EET) of the next trading day | Instantly | 00:05 (EET) of the Monday of next week |

| Maximum leverage limit | Instantly | 00:05 (EET) of the Monday of next week | |||

| Maximum weekly loss | The value of the account equity at 00:05 (EET) of the Monday of the current week | The value of the account equity (in percent) falls by the size of the given limit | 00:05 (EET) of the Monday of next week | Instantly | 00:05 (EET) of the Monday of next week |

| Maximum drawdown limit (indefinite) | The maximum value of the account equity after the limit level has been set / changed | The value of the account equity (in the account currency) falls to the given value | 00:05 (EET) of the Monday of next week | Instantly | 00:05 (EET) of the Monday of next week |

| Minimum balance level (indefinite) | - | The value of the account equity (in the account currency) falls to the given value | Only after the account has been recharged or the limit size changed | Instantly | 00:05 (EET) of the Monday of next week |

Notes:

- None of the limits are compulsory for independent trading.

- The time at which the initial value of the parameter used in further calculations is recorded.

- If the client requests for a change.

Features of the functional

Deposit and withdrawal requests are accepted only on weekends. You can deposit or withdraw directly at the beginning of the trading week (Monday 00:05 EET) with automatic correction of risk management values (in monetary terms, the ratio is not corrected if there is no request to change risk management parameters).

When withdrawing funds, the "Minimum balance" parameter (if it is set) must be taken into account. Since the "Minimum balance" is a fixed value in the currency, then when withdrawing an amount that makes the account equity to become less than the "Minimum balance" value, the "Minimum balance" limit will be triggered and trading on that account will be blocked during withdrawal (Monday 00:05 EET).

Requests to change risk management parameters are executed at the beginning of the trading week (Monday 00:05 EET).

The risk management system can be accessed in the personal account in the trading account settings.