ICE Markets operates a 100% A-book model, hedging all trades with external counterparties. The company has no conflict of interest with clients and it is not interested in clients' losses, since it earns only from transaction commissions paid.

Advantages of a 100% A-book model

No conflict of interest

For B-book and "mixed" models, the company acts as a counterparty to the client's transactions, and the customer's earnings become the company's losses and vice versa.

An A-book model completely eliminates conflict of interests between the company and clients – ICE Markets does not act as counterparty to the client's transactions and is not interested in their losses.

No bankruptcy risk

For B-book and "mixed" models, the company acts as a counterparty to the client's transactions, and the customer's earnings become the company's losses and vice versa.

This reason has pushed quite a large number of companies into bankruptcy due to the very large amount earned by customers in a short period of time.

ICE Markets does not bear these bankruptcy risks because it does not act as counterparty to clients' transactions.

Note!

During bank rollover – from 23:50 to 00:05 (EET time) – liquidity reduces, and the spread and processing time of client orders may increase.

When transferring orders across all groups of instruments from Wednesday to Thursday, swap is charged at a triple rate.

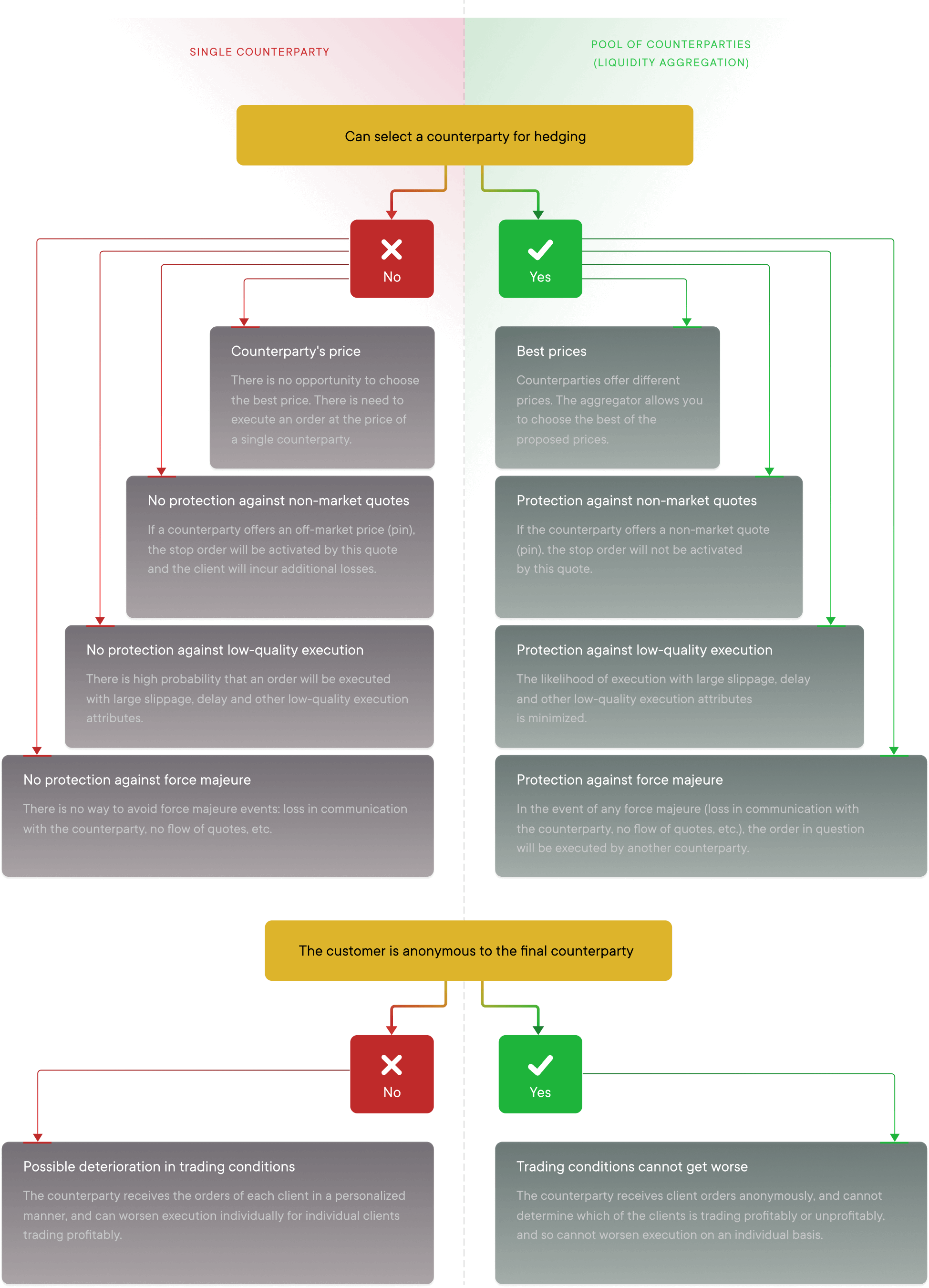

ICE Markets provides customers with liquidity, aggregated from several counterparties. This gives a number of advantages: customers always receive the best prices, they are protected against low-quality order execution by a counterparty, and are completely anonymous to him.

Note!

During bank rollover – from 23:50 to 00:05 (EET time) – liquidity reduces, and the spread and processing time of client orders may increase.

When transferring orders across all groups of instruments from Wednesday to Thursday, swap is charged at a triple rate.